oregon tax payment extension

Oregon Department of Revenue PO. The Oregon Department of Revenue announced it is joining the IRS and automatically extending the tax year 2020 filing due date for individuals from April 15 2021 to.

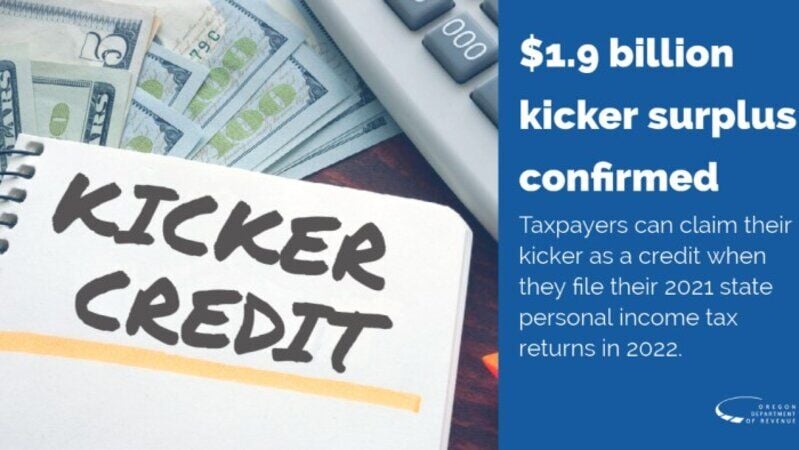

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

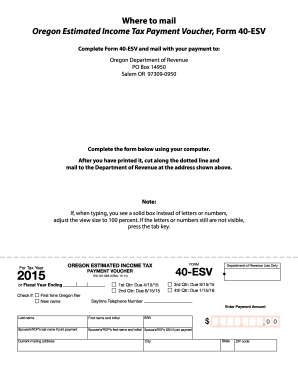

Where to mail the Oregon business tax extension payment voucher.

. Detach Oregon Form 40-EXT and mail by April 15 2022. Even if you file an extension the tax liability must be paid in full by the original due date otherwise penalties and interest will be assessed. If you are making a payment for more than one personal tax program please a complete a separate voucher for each program.

Individual Income Tax ReturnAn extension of time to file is not. However you should not. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs.

Download and complete the Personal Income Tax Voucher. Mail a check or money order. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

For more information please visit our. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools. Use Form PIT-V to make an extension payment which must be remitted by the original return due date generally April 15 for an.

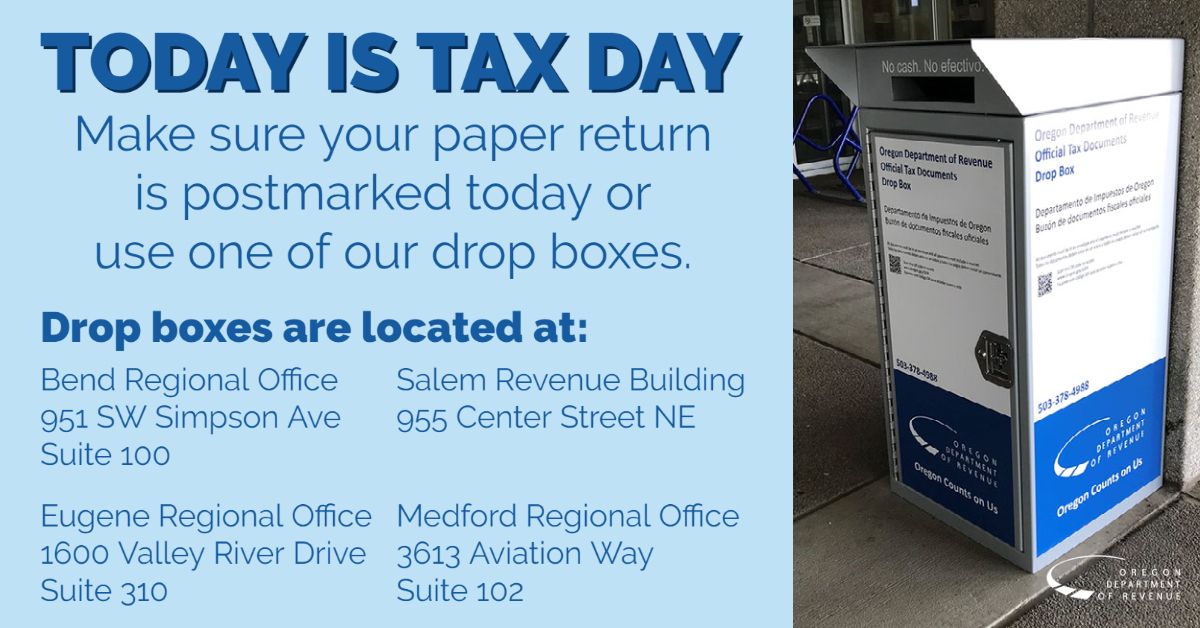

Do not file Form 40-EXT if you have a valid Federal extension and you expect to receive an Oregon tax refund. Specific instructions If you owe Oregon tax for 2021 and you need more time to file your Oregon return use the tax payment worksheet on the next page to calculate your extension payment and follow the payment instructions under Payment options To avoid penalty and interest make your extension payment by April 18 2022. Taxes for 2021 need to be filed by April 18 2022.

WASHINGTON - Monday is Tax Day 2022 the federal deadline to file income tax returns and pay taxes owed and the IRS expects millions of last. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. Whether you owe Oregon tax for 2021 or not mark the.

To avoid interest and penalties your Oregon tax liability must be fully paid by the original deadline. To request an Oregon extension file Form 40-EXT by the original due date of your return. Use only blue or black ball point ink.

Extension payments can also be made online via Oregons. Electronic payment from your checking or savings account. Phone 800 356-4222 Online.

Make a tax payment with your extension using Form OR-40 Estimated Tax Declaration Voucher and attach it to Form OR-40-EXT. OR personal income tax returns are due by April 15 th in most years. The deadline to submit 2021 tax returns or an extension to file and pay tax owed this year falls on April 18 instead of.

Oregon Tax Extension Form. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time. You dont need to request an Oregon extension unless you owe a payment of Oregon tax.

An extension of time to file is not an extension of time to pay. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. Electronic payment options are available at IRSgovpayments.

Payment is coordinated through your financial institution and they may charge a fee for this service. Oregon offers a 6-month extension which moves the filing deadline from April 15 to October 15. Oregon Tax Extension Form.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. Pay by phone or online. Interest is due on tax not paid by the original due date.

Oregon Extension Payment Requirement. Check the Extension Filed box when you file your personal income tax returns and attach a copy of your federal extension or verification of your Oregon extension payment with your return. If you dont have a Federal extension and you owe Oregon income tax use Form 40-EXT Application for Automatic Extension of Time to File Oregon Individual Income Tax Return to request an Oregon-only extension and pay your state tax.

Penalty will be assessed for underpayment unless the extension payment is 90 of the current year tax or 100 of prior year tax. Taxpayers who have filed their 2020 Oregon tax returns and owe unpaid taxes should pay the tax due by May 17 2021. Mail the completed Form OR-20-V extension payment voucher to the following address.

Write your daytime phone number and 2019 40-EXT on your payment. Pay your personal tax by mail. If you owe Oregon state taxes you must pay your tax due by the regular due date or you will be charged with penalties and interest.

If you owe Oregon personal income tax follow the instructions on Publication OR-EXT to. The IRS estimates 15 million taxpayers will request an extension of time to file and the easiest way to request an extension to file is using IRS Free FileIn a matter of minutes anyone can request an extension until October 17 using Form 4868 Application for Automatic Extension of Time to File US. You can make an Oregon extension payment with Form 20-V or pay electronically through Oregons Electronic Services center.

Oregon Filing Due Date. Extended Deadline with Oregon Tax Extension. Federal automatic extension federal Form 4868.

Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply. When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form. Do not postdate your check.

A tax extension gives you more time to file but not more time to pay. Box 14950 Salem OR 97309-0950. Or to make an extension payment by mail download.

You can make a state extension payment using Oregon Form 20-V Oregon Corporation Tax Payment Voucher. If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers. This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension.

Along with the extension form send a check or money order in the amount of the estimated tax due made payable to Oregon Department of Revenue.

Irs Tax Extension To Jan 15 For California Wildfire Victims California Wildfires Prayers Coast Guard Boats

Super Fast Travel Using Outer Space Could Be 20 Billion Market Disrupting Airlines Ubs Predicts Space Travel Space Tourism Tourism Marketing

Where S My Oregon State Tax Refund Taxact Blog

State Of Oregon Oregon Department Of Revenue Payments

I Still Love You Even Though It Puts Me In A Tax Bracket I Can T Afford Love You Funny Accounting Humor Ecards Funny

Loan Agreement Template Sample Loan Loan Money Agreement

Oregon Estimated Tax Payment Fill Out And Sign Printable Pdf Template Signnow

Mobile Web In India Sales Tax Taxes Humor Tax Day

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Classroom Guide To Fire Safety By The Oregon State Fire Marshal Fire Safety Classroom Classroom Projects

Oregon State 2022 Taxes Forbes Advisor

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

What Is The Oregon Transit Tax How To File More

It S Tax Time Here Are Some Last Minute Tips For Oregon Residents As The Deadline Looms

Oregon Revenue Dept Orrevenue Twitter

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com