michigan gas tax increase history

And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. Buck 92 WHATS ON TAP.

Us Housing Inventory Requiring Deleveraging Estimated At 30 Million The Unit House Inventory

Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon.

. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247. But you also pay the Michigan 6 percent sales tax. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes.

In 1960 voters approved an increase of the 3 sales tax to 4 effective January 1 1961. At least eight states have hiked gas taxes since 2013. Whitmers proposed three-step increase over a one-year period would give Michigan the highest fuel taxes in.

For fuel purchased January 1 2022 and after. Thirteen states have gone two decades or more without a gas tax increase. Currently Michigans fuel excise tax is 263 cents per gallon cpg.

13 In fact gas taxes accounted for about one-fifth of the 250 average price for a gallon of gas in early 2021. Map shows gas tax increases in effect as of March 1 2021. Alternative Fuel which includes LPG 263 per gallon.

Based on retail price of 2746 per gallon Michigan average for regular gasoline during 2018. Buck 92 Listen Live. Michigan fuel taxes last increased on Jan.

Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. To increase the state gasoline and diesel taxes to between 23 cents and 30 cents per gallon depending on the wholesale price of these fuels. Diesel Fuel 263 per gallon.

A proposal to amend the State Constitution to increase the salesuse tax from 6 to 7 to replace and supplement reduced revenue to the School Aid Fund and local units of government caused by the elimination of the salesuse tax on gasoline and diesel fuel for vehicles operating on public roads and to give effect to laws that provide additional money for roads. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon. 1 2017 as a result of the 2015 legislation.

30 0003 General Fund 00 0000 What Makes Up the Price of a Gallon of Gas Assuming gasoline costs 200 per gallon Figure 2 of a gallon of gasoline is 200 per gallon the Michigan sales tax comprises 102 cents of that price. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Hohman was referring in part to the 45-cent per gallon gas tax proposed by Gov.

Federal excise tax rates on various motor fuel products are as follows. Voters in Michigan on May 5 will decide whether to hike the sales tax that would. The gasoline tax of 19 cents a gallon will.

0183 per gallon. This week Gov. Win tickets to the SOLD OUT Theresa Caputo Show 42922.

Liquefied Natural Gas LNG 0243 per gallon. The package of bills included increasing the gasoline tax by 73 cents per gallon to 263 cents starting in 2017 and registration fees by 20 but Michigans transportation chief at. Whitmer proposed a 45-cent gas tax increase to help fix Michigans crumbling roads.

The cost of vehicle registration isnt the only travel related price increase coming in 2017. Starting January 1 2017 gas taxes will increase 73 cents and diesel will. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

It is the states first fuel tax hike in 20 years and the first major vehicle fee increase since 1983. Gasoline 263 per gallon. Michael McCready R on June 17 2015.

Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on unincorporated businesses. Throw in the 184-cent federal tax and it starts to add up. Gretchen Whitmer as part of her attempt to raise more than 25 billion to honor her 2016 campaign promise to fix.

Gasoline 272 per gallon. 10 states to have gone two decades or more without a gas tax increase. Nineteen states have waited a decade or more since last increasing their gas tax rates.

36 states have raised or reformed gas taxes since 2010. When gas is 389 per gallon that. Under the governors proposal a 45-cent increase would occur in three.

Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev. BUCK 923 LIVE. Diesel Fuel 272 per gallon.

Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel. The tax on regular fuel increased 73 cents per gallon and the tax on diesel fuel increased 113 cents per. The Michigan gas tax will also rise 73 cents per gallon.

Sharing 240 0025 Comp. 1 Among the findings of this analysis. Michigans diesel fuel tax was adopted in 1947 at a rate of five cents per gallon.

Win BIG with My Music Madness 20-22. The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased. Two years later in 1927 the rate was increased to three cents per gallon.

For fuel purchased January 1 2017 and through December 31 2021. Then another constitutional amendment increased that to 6 in 1994 through another vote. Public Act 176 of 2015.

The current gas and diesel tax rates are 19 cents and 15 cents per gallon respectively.

A New Map Courtesy Tax Foundation Shows Where Pennsylvania Stacks Up On State Gas Taxes For More Infographic Map Safest Places To Travel Best Places To Retire

Where S Waldo By Martin Handford Classic Childrens Books Children S Books Classic Kids

Motor Fuel Taxes Urban Institute

Vintage Wisconsin Senate News Summer 1975 Single Sheet W Info On Both Sides

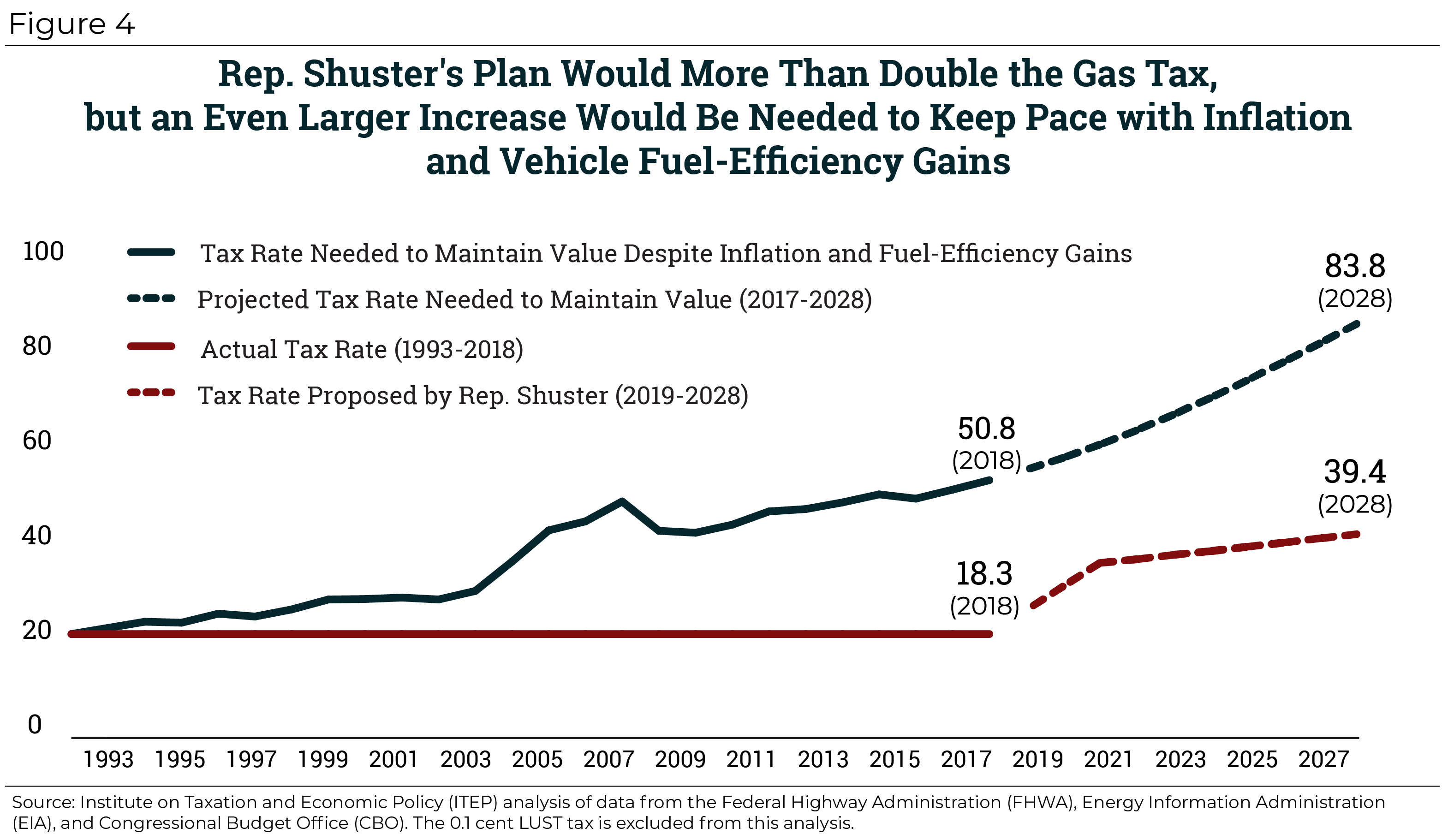

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

A Landlord S Guide To Renting A Property The Allstate Blog Being A Landlord Rental Income Income Property

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Tax Base Definition What Is A Tax Base Taxedu

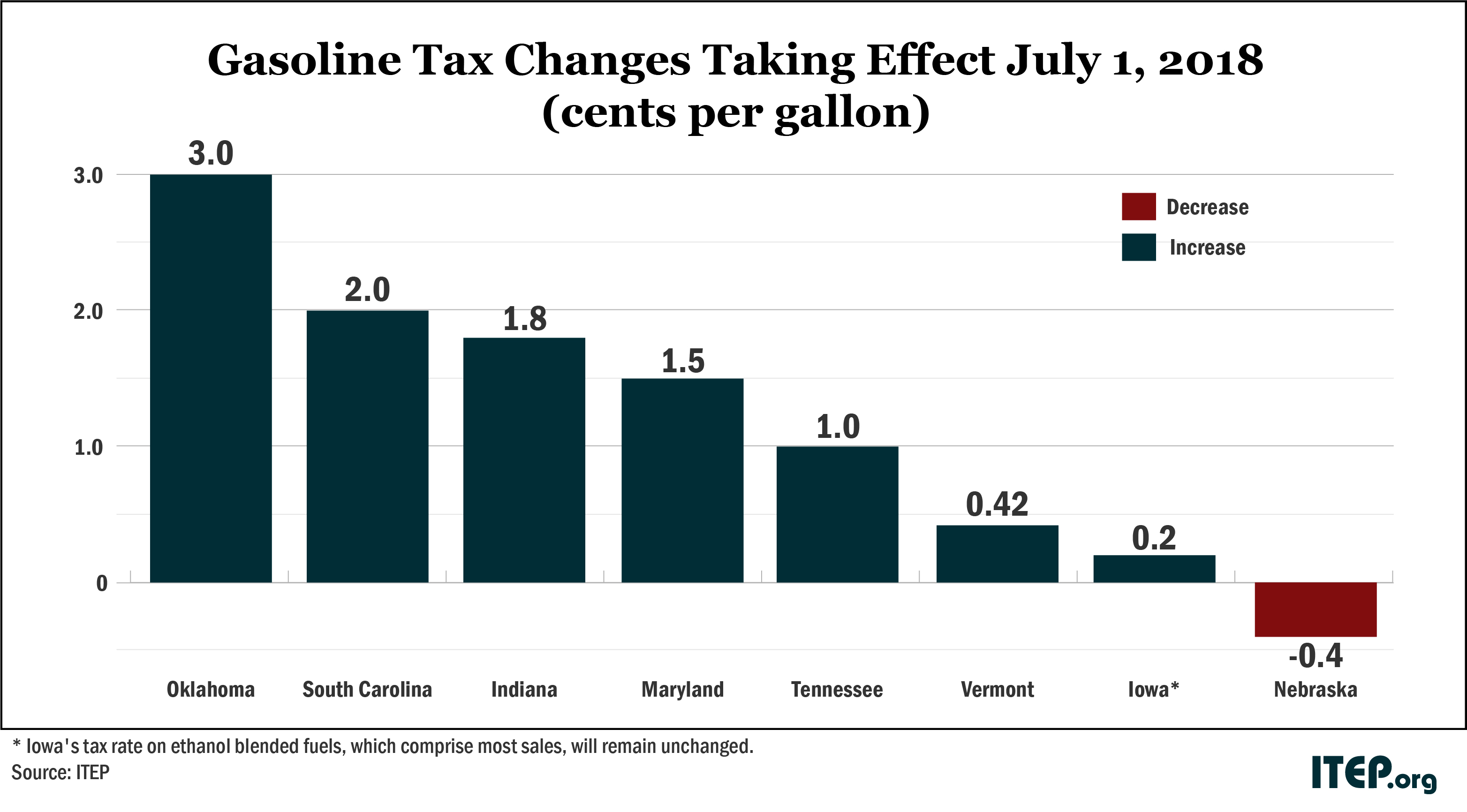

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Most States Have Raised Gas Taxes In Recent Years Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

.png)

Map State Gasoline Tax Rates Tax Foundation

U S States With Highest Gas Tax 2022 Statista

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded